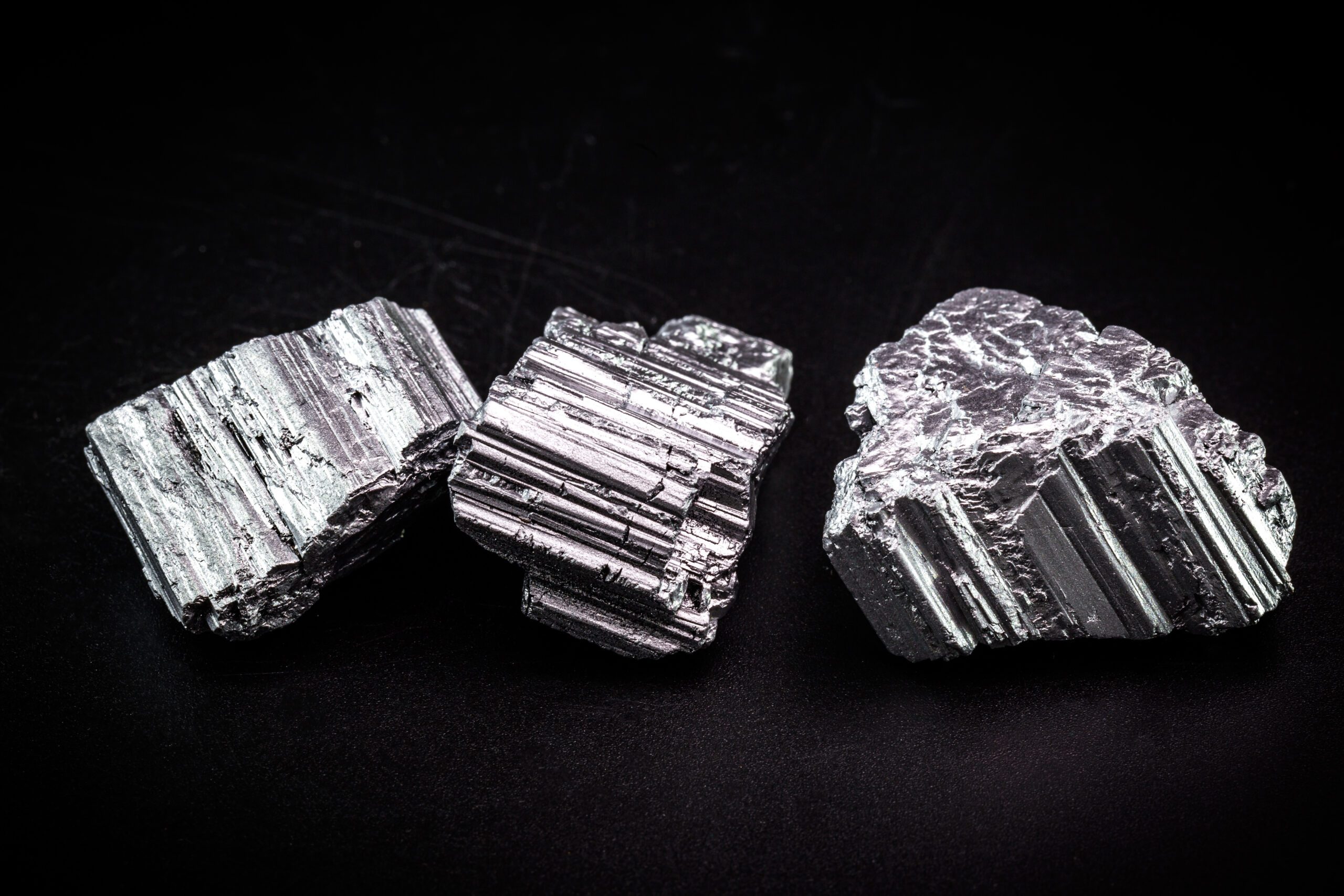

Metals and mining

Market-reflective prices and analysis to help you navigate volatile, opaque markets

Metals and mining market participants like you have been turning to Fastmarkets for help in evaluating opportunities and risks for more than 130 years.

Supply chains are constantly moving and metals prices fluctuate while the lasting impact of Covid-19, the war in Ukraine and the pull of decarbonization create uncertainty in the market.

Fastmarkets metals and mining team works with those involved in the buying, selling and trading of metals to deliver truly market-reflective prices and insights to successfully enable global trade.

Combining the commodity intelligence of familiar names like Metal Bulletin, American Metal Market, Scrap Price Bulletin, Industrial Minerals and more, our product breadth and geographic reach remain unmatched.

Talk to our experienced, global team and discover more than 900 prices and news and analysis in primary and secondary metals markets. We cover base metals, industrial minerals, ores and alloys, steel, scrap and steel raw materials.

Build your personalized view of the metals markets in the Fastmarkets dashboard

Latest metals and mining news and market analysis

Talks between the European Union and the United States began in October 2021, where both parties announced the Global Arrangement on Sustainable Steel and Aluminium (GASSA), a partnership in which both parties would negotiate an arrangement to combat global overcapacity and climate change. The discussions would include discouraging trade in high-carbon steel and aluminum that […]

NANO has targeted remote mining operations run by diesel fuel in locations where the logistics of providing a constant source of fuel “may be a challenge,” the CEO said. The company’s microreactors could also expand mining opportunities to more new locations. “It can make thousands of potential mines economic and come online, whereas before, they […]

US steel scrap prices ahead of November trade The Trend Indicator has rebounded into bullish territory, at 61.4 for November compared with a resolutely bearish 45.6 in October. This month’s indicator is at its highest since March’s outlook, when it was 65.2. The Outlook’s prediction model allows for an average month-on-month price increase of 5.1%. Respondents […]

Fastmarkets assessed its new aluminium low-carbon differential P1020A, US Midwest at zero on Friday November 3. The assessment for the aluminium low-carbon differential for value-added product, US Midwest, also was at zero on Friday. Fastmarkets aims to bring transparency to the market with its new low-carbon aluminium differentials. “We are getting lots of questions about carbon […]

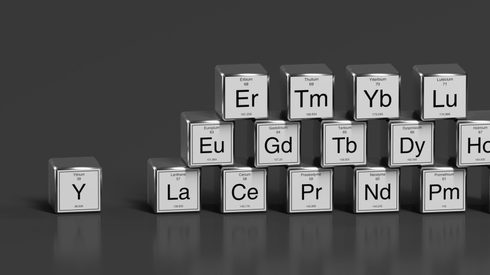

Chinese rare earth producer Shenghe Resources has entered into a subscription agreement with Vital Metals Limited, increasing its resource reserves in overseas rare earth mining projects

Steel producers reinvesting in coal-based steelmaking are potentially locking in millions of tonnes more carbon dioxide emissions

Aluminium scrap market news and analysis for aluminium scrap buyers, sellers and traders

Keep up with the movements of aluminium as one of the most-watched metals on the market

The trends and forces driving the cobalt market

Learn more about copper and view copper price charts

Ferrous scrap, recycling and the circular economy

News, price and analysis of the innovative world of synthetic and natural graphite

Follow the critical developments facing the iron ore market, including iron ore market forecasts and analysis and iron ore price data

How the lithium market is helping shape a greener future

Playing an essential role in building global infrastructure

Keep track of the dynamics and volatility in the nickel market

Understand the forces shaping the tube and pipe market today

Find out how we assess and forecast prices for the global metals market

November 19-21 | Prague, Czech Republic

Join 800+ peers at the largest gathering of ferroalloys traders and deal-makers in Europe. Find the organizations critical to your business at this focused networking event. Set yourself up for success in 2024.

November 20-22 | Dubai, UAE

1,000+ key decision-makers from across MENA are coming together to discuss and identify opportunities in decarbonization and mega-projects across the region. Meet the biggest steel-makers all in one place.

January 22-24, 2024 | Houston, USA

As the industry undergoes seismic change in the move to decarbonization, hear from experts and meet with your peers to build your strategy across 2024. Connect with decision-makers in Houston in January.

February 26-28, 2024 | Hong Kong, China

Join 800+ of your ferroalloys colleagues from across Asia, and the world at the region’s largest trading event.

Our global team of over 200 price reporters provides over 900 global metal and mining prices

Delivered to you as the markets are changing from reporters embedded in the global metals and mining markets

With an over 90% accuracy rating, our forecasting helps you understand what’s next for the metals and mining market

Grow and protect your profits and insulate your business from volatility with the Fastmarkets risk management team

Learn how the Fastmarkets platform can help you navigate the fast-moving metals market

Fastmarkets’ metal events provide immersive experiences across the global metals markets

Speak to our team

Learn more